What makes a good LBO candidate? This question lies at the heart of successful leveraged buyouts (LBOs), where investors seek to acquire companies with the potential for significant growth and value creation. Understanding the key characteristics and financial metrics that define an attractive LBO target is crucial for investors seeking to maximize their returns.

LBOs involve the acquisition of a target company using a substantial amount of debt financing. The ability of the acquired company to generate sufficient cash flow to service this debt and drive post-acquisition growth is paramount. Thus, investors carefully evaluate a range of factors, including the company’s financial health, industry dynamics, and management team.

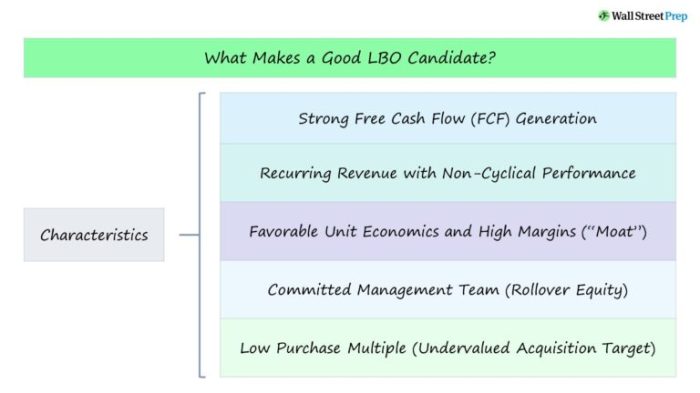

Key Characteristics of a Strong LBO Candidate

A suitable LBO candidate possesses specific financial attributes, operates in favorable industry sectors, and exhibits business models that align with LBO strategies. These characteristics enhance the likelihood of a successful LBO transaction.

Financial Attributes

Strong financial attributes are crucial for LBO candidates. These include:

- Stable cash flow: Predictable and sufficient cash flow is essential for servicing debt obligations.

- Low leverage: Existing debt levels should be manageable, allowing for additional debt financing.

- High EBITDA margins: EBITDA (earnings before interest, taxes, depreciation, and amortization) margins indicate the company’s profitability and ability to generate cash.

- Long-term growth potential: The company should have prospects for sustainable growth, ensuring future cash flow generation.

Industry Sectors

Certain industry sectors are more conducive to LBOs due to their:

- Recession resistance: Industries less affected by economic downturns provide stability for LBO investments.

- High barriers to entry: Sectors with high barriers to entry protect LBO companies from competition.

- Consolidation opportunities: Industries undergoing consolidation present opportunities for LBOs to acquire and merge businesses.

Business Models

Suitable LBO business models include:

- Asset-intensive businesses: Companies with significant tangible assets, such as real estate or equipment, can leverage these assets to secure financing.

- Subscription-based businesses: Recurring revenue streams from subscriptions provide stable cash flow for LBOs.

- Turnaround situations: Companies with potential for improvement through operational or financial restructuring are attractive LBO targets.

Examples of Successful LBOs

Notable LBOs that exemplify these characteristics include:

- KKR’s acquisition of RJR Nabisco (1988): High EBITDA margins, low leverage, and a stable consumer products industry.

- Apollo Global Management’s acquisition of Clear Channel Communications (2008): Recession-resistant media sector, high barriers to entry, and significant asset value.

- Silver Lake Partners’ acquisition of Dell Technologies (2013): Subscription-based revenue model, long-term growth potential, and a technology sector with high barriers to entry.

Financial Metrics for LBO Evaluation

Financial metrics play a crucial role in assessing the feasibility and attractiveness of a potential LBO candidate. Lenders and investors use these ratios to evaluate the company’s financial health, debt capacity, and ability to service its debt obligations.

Key Financial Ratios for LBO Evaluation, What makes a good lbo candidate

| Ratio | Formula | Significance |

|---|---|---|

| EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization | Measures the company’s cash flow from operations, which is used to repay debt. |

| Debt-to-Equity Ratio | Total Debt / Shareholders’ Equity | Indicates the proportion of debt financing used to fund the company’s assets. A higher ratio suggests a higher risk of financial distress. |

| Interest Coverage Ratio | EBITDA / Interest Expense | Assesses the company’s ability to cover its interest payments with its cash flow from operations. A ratio below 1.5 may indicate a high risk of default. |

Example

In a real-life LBO transaction, a private equity firm acquired a manufacturing company with the following financial metrics:

EBITDA

$50 million

Total Debt

$100 million

Shareholders’ Equity

$50 million

Interest Expense

$10 millionThe Debt-to-Equity Ratio is 2.0, which is relatively high but within an acceptable range for LBOs. The Interest Coverage Ratio is 5.0, indicating that the company can comfortably cover its interest payments. These metrics suggest that the company is a viable LBO candidate with a strong financial profile.

Management Team and Business Plan

The management team plays a pivotal role in the success of an LBO. A strong management team with a proven track record of execution and a clear vision for the future of the business is essential for driving post-LBO growth and value creation.

Role of Management Team in Developing a Credible Business Plan

The management team is responsible for developing a credible business plan that Artikels the post-LBO growth strategy. This plan should include detailed financial projections, operational targets, and a clear articulation of the value creation drivers. The credibility of the business plan is crucial for securing financing and convincing investors of the potential for value enhancement.

Case Studies of LBOs Where Management Team Execution Played a Critical Role in Value Creation

There are numerous examples of LBOs where the execution of the management team has been instrumental in driving value creation. One notable example is the LBO of Dollar General in 2007. The management team, led by CEO Rick Dreiling, implemented a series of operational initiatives that improved store efficiency, increased sales, and expanded the product offerings.

These initiatives resulted in significant revenue and EBITDA growth, leading to a substantial increase in the company’s valuation.

Market Dynamics and Exit Strategies: What Makes A Good Lbo Candidate

Market dynamics and exit strategies are crucial factors in determining the viability and success of an LBO. Understanding the impact of market conditions and developing a well-structured exit plan are essential for LBO investors.

Interest rates and economic growth are key market conditions that affect LBO viability. Rising interest rates can increase the cost of debt financing, making LBOs more expensive and reducing potential returns. Strong economic growth, on the other hand, can lead to increased demand for goods and services, benefiting LBO companies and enhancing their ability to repay debt.

Exit Strategies

LBO investors typically have several exit strategies available to them, each with its own advantages and disadvantages:

- Initial Public Offering (IPO):Selling shares of the acquired company to the public through an IPO can provide LBO investors with a significant exit return. However, IPOs can be time-consuming and expensive, and the success of an IPO depends on market conditions.

- Sale to a Strategic Buyer:Selling the acquired company to another company in the same industry can provide LBO investors with a quick and efficient exit. Strategic buyers may be willing to pay a premium for a company that complements their existing operations.

- Sale to a Financial Buyer:Selling the acquired company to another private equity firm or hedge fund can provide LBO investors with a more flexible exit option. Financial buyers may be willing to hold the company for a longer period and provide additional financing if needed.

Successful LBO Exits

Numerous successful LBO exits have been executed over the years, demonstrating the potential for significant returns for LBO investors. One notable example is the LBO of Kinder Morgan, an energy infrastructure company, by The Carlyle Group in 2002. Carlyle acquired Kinder Morgan for $2.1 billion and implemented a series of operational improvements that increased the company’s value.

In 2011, Carlyle sold Kinder Morgan through an IPO, generating a return of over $6 billion.

Helpful Answers

What is the ideal debt-to-equity ratio for an LBO candidate?

The optimal debt-to-equity ratio varies depending on the industry, company size, and specific circumstances of the LBO. However, a ratio between 3:1 and 6:1 is generally considered acceptable.

How important is the management team in an LBO?

The management team plays a critical role in the success of an LBO. They are responsible for executing the business plan, driving growth, and ensuring the company’s financial performance. A strong management team with a proven track record and clear vision is highly valued by investors.