Embark on a comprehensive journey into the realm of claims adjusting with our invaluable claims adjuster study guide PDF. As a roadmap to success, this guide empowers you to navigate the intricacies of insurance claims, equipping you with the knowledge and skills to excel in this dynamic field.

Within its pages, you’ll delve into the fundamentals of claims adjusting, exploring the roles and responsibilities of these professionals. Understand the various types of insurance claims and gain insights into the claims adjustment process, from investigation to settlement.

Claims Adjuster Study Guide Overview: Claims Adjuster Study Guide Pdf

A claims adjuster study guide is a valuable resource for individuals preparing for the claims adjuster licensing exam. It provides comprehensive coverage of the topics tested on the exam, including insurance policies, claims handling procedures, and legal issues. Using a study guide can help you understand the material more thoroughly, identify areas where you need additional support, and improve your chances of passing the exam on the first attempt.

Before you head to the field for some competitive fun, be sure to check out our claims adjuster study guide PDF. And if you’re looking for some fun activities to keep the kids entertained while you’re studying, check out our field day fun breakout answers . Once you’re back from the field, don’t forget to finish up your claims adjuster study guide PDF!

There are different types of claims adjuster study guides available, including books, online courses, and practice exams. Books are a good option for individuals who prefer to learn at their own pace and have the flexibility to study anywhere. Online courses offer a more structured learning experience with interactive features and access to instructors.

Practice exams can help you assess your knowledge and identify areas where you need to focus your studies.

Choosing the Right Study Guide

When choosing a claims adjuster study guide, it is important to consider your learning style, the amount of time you have available to study, and your budget. It is also helpful to read reviews from other students to get an idea of the quality of the material.

Once you have chosen a study guide, it is important to create a study schedule and stick to it. Regular study sessions will help you stay on track and improve your chances of success.

Claims Adjusting Fundamentals

Claims adjusting is a vital part of the insurance industry, helping to ensure that policyholders receive fair and timely compensation for their losses. Claims adjusters play a crucial role in investigating, evaluating, and settling insurance claims.

The responsibilities of a claims adjuster include:

- Investigating the circumstances of a loss

- Interviewing witnesses and gathering evidence

- Determining the extent of the damage or loss

- Authorizing payment of claims

li>Negotiating settlements with policyholders

Types of Insurance Claims

There are many different types of insurance claims, including:

- Property claims: These claims are filed when property is damaged or destroyed, such as in the case of a fire, flood, or theft.

- Liability claims: These claims are filed when someone is injured or killed due to the negligence of another person or business.

- Auto claims: These claims are filed when a vehicle is damaged or destroyed in an accident.

- Health claims: These claims are filed when someone incurs medical expenses due to an illness or injury.

- Disability claims: These claims are filed when someone is unable to work due to a disability.

Claims Adjustment Process

The claims adjustment process typically involves the following steps:

- Reporting the claim:The policyholder reports the claim to their insurance company.

- Assigning a claims adjuster:The insurance company assigns a claims adjuster to the case.

- Investigating the claim:The claims adjuster investigates the claim by gathering evidence and interviewing witnesses.

- Determining the extent of the damage or loss:The claims adjuster determines the extent of the damage or loss and the amount of the claim.

- Negotiating a settlement:The claims adjuster negotiates a settlement with the policyholder.

- Authorizing payment of the claim:The claims adjuster authorizes payment of the claim to the policyholder.

Investigating and Evaluating Claims

Investigating and evaluating claims is a critical step in the claims adjustment process. It involves gathering information, assessing the validity of the claim, and determining the appropriate course of action.

There are several different methods of investigating claims, including:

- Interviews:Interviewing the claimant, witnesses, and other relevant parties can provide valuable information about the circumstances of the claim.

- Document review:Reviewing documents such as medical records, police reports, and insurance policies can help to verify the claimant’s story and establish the facts of the case.

- Site inspections:Visiting the location of the loss or damage can provide firsthand knowledge of the circumstances and help to assess the extent of the damage.

li> Surveillance:In some cases, surveillance may be necessary to gather evidence or verify the claimant’s statements.

Once the investigation is complete, the claims adjuster must evaluate the validity of the claim. This involves assessing the credibility of the claimant, the evidence supporting the claim, and the applicable policy provisions.

The following types of evidence can be used to support claims:

- Physical evidence:This includes damaged property, medical records, and other tangible evidence that can support the claimant’s story.

- Documentary evidence:This includes insurance policies, receipts, and other documents that can provide information about the loss or damage.

- Witness statements:Statements from witnesses who have firsthand knowledge of the circumstances of the claim can be valuable evidence.

- Expert testimony:In some cases, expert testimony may be necessary to provide an opinion on the cause of the loss or damage or the extent of the injuries.

Once the claims adjuster has evaluated the validity of the claim, they will determine the appropriate course of action. This may include approving the claim, denying the claim, or offering a settlement.

Negotiating and Settling Claims

Negotiating and settling claims is a crucial aspect of a claims adjuster’s role. It involves reaching an agreement with the claimant that is fair, equitable, and compliant with insurance policies and regulations.

Claims adjusters employ various negotiation techniques to achieve a mutually acceptable settlement. These techniques include:

- Principled negotiation:Focuses on interests and objectives rather than positions, aiming for a win-win outcome.

- Interest-based negotiation:Identifies and addresses the underlying interests of both parties, seeking a solution that meets their needs.

- Positional negotiation:Involves each party stating their initial position and gradually compromising until an agreement is reached.

Factors Influencing Settlement Amounts

The settlement amount is influenced by several factors, including:

- Policy limits:The maximum amount payable under the insurance policy.

- Evidence of loss:Documentation supporting the claimant’s claim, such as medical records, repair estimates, or police reports.

- Liability:The extent to which the insured is legally responsible for the loss.

- Comparative negligence:If multiple parties are involved in the incident, their respective degrees of fault can impact the settlement.

- Prior settlements:Previous settlements for similar claims can provide guidance on reasonable amounts.

Types of Settlement Agreements

Settlement agreements can take various forms:

- Cash settlement:A lump sum payment to the claimant.

- Structured settlement:Payments made over a period of time, often used for future medical expenses or lost income.

- Release and waiver:A legal document that releases the insurer from further liability related to the claim.

Ethical and Legal Considerations

Claims adjusters have a significant responsibility to act ethically and legally in their work. Ethical behavior ensures fairness and impartiality in claims handling, while legal compliance protects both the claims adjuster and the company they represent from potential liabilities.

Ethical Responsibilities

- Fairness and Impartiality:Claims adjusters must treat all parties involved in a claim fairly and impartially, without bias or favoritism.

- Honesty and Transparency:They must provide accurate and complete information to all parties, and avoid misleading or withholding relevant facts.

- Confidentiality:Claims adjusters have a duty to maintain the confidentiality of all information obtained during the claims process.

- Conflict of Interest:They must avoid any situations where their personal interests could conflict with their professional responsibilities.

Legal Requirements

Claims adjusters must adhere to various legal requirements, including:

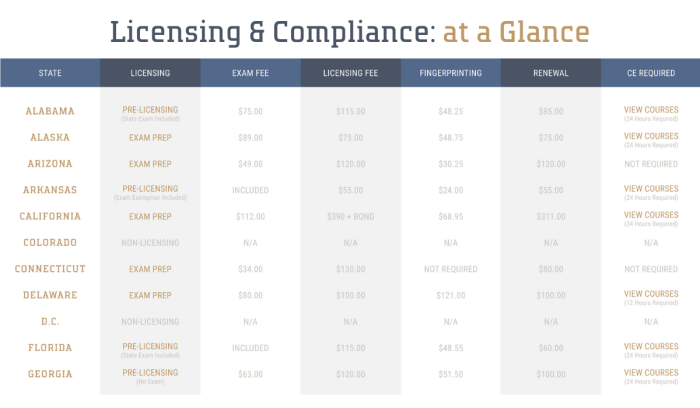

- Insurance Regulations:State insurance regulations govern the conduct of claims adjusters, including licensing requirements and ethical standards.

- Fair Claims Settlement Practices:Federal and state laws prohibit unfair or deceptive practices in claims handling.

- Anti-Discrimination Laws:Claims adjusters cannot discriminate against any party based on race, gender, religion, or other protected characteristics.

- Privacy Laws:They must comply with privacy laws that protect the personal information of claimants.

Consequences of Violations

Violating ethical or legal standards can have serious consequences, including:

- Loss of License:Claims adjusters who violate ethical or legal standards may lose their license to practice.

- Legal Liability:They may be held legally liable for damages caused by their misconduct.

- Reputational Damage:Unethical or illegal behavior can damage the reputation of the claims adjuster and the company they represent.

Continuing Education and Professional Development

Continuing education is essential for claims adjusters to stay abreast of industry changes, enhance their skills, and maintain their professional credibility.

Claims adjusters can pursue continuing education through various avenues, including:

Online Courses

- Offer flexibility and convenience, allowing adjusters to learn at their own pace.

- Cover a wide range of topics, including claims handling, investigation techniques, and negotiation strategies.

Conferences and Seminars, Claims adjuster study guide pdf

- Provide opportunities for networking and staying up-to-date on industry trends.

- Offer in-depth training on specific topics, such as complex claims or new legislation.

Professional Certifications

- Demonstrate a claims adjuster’s knowledge and expertise.

- Enhance credibility and open up career advancement opportunities.

Practice Exams and Sample Questions

Practice exams and sample questions are valuable resources for preparing for the claims adjuster exam. They provide an opportunity to test your knowledge, identify areas where you need additional study, and familiarize yourself with the types of questions that you will encounter on the actual exam.

To use practice exams and sample questions effectively, it is important to:

- Take the exams under timed conditions to simulate the actual exam experience.

- Review your answers carefully and identify any areas where you made mistakes.

- Use the practice exams and sample questions to identify areas where you need additional study.

Types of Questions

The claims adjuster exam typically includes a variety of question types, including:

- Multiple choice questions

- True/false questions

- Short answer questions

- Essay questions

It is important to be familiar with all of these question types and to practice answering them effectively.

Expert Answers

Is this study guide suitable for both beginners and experienced claims adjusters?

Absolutely! Our claims adjuster study guide PDF is designed to cater to the needs of individuals at all levels of experience. Whether you’re just starting out or looking to enhance your existing knowledge, this guide provides a comprehensive foundation and valuable insights.

How often is the study guide updated to reflect industry changes?

We understand the importance of staying up-to-date in this rapidly evolving field. Our claims adjuster study guide PDF is regularly reviewed and updated to ensure that it aligns with the latest industry best practices and regulatory requirements.

What types of practice questions and sample exams are included in the study guide?

To help you prepare effectively for the claims adjuster exam, our study guide includes a wide range of practice questions and sample exams. These questions cover various aspects of claims adjusting, allowing you to test your knowledge and identify areas for improvement.